SAFE HAVEN

In times of global instability, asset investment companies tend to hedge their money into a robust and stable currency. The Swiss Franc is one of these so-called „safe haven currencies“. The financial crisis, the trade war between China and the US – these events caused a similar behavior amongst the global asset investors: they increasingly invest in bonds from the Swiss National Bank. The effect on the CHF: the currency gets stronger and rises its value on the financial market.

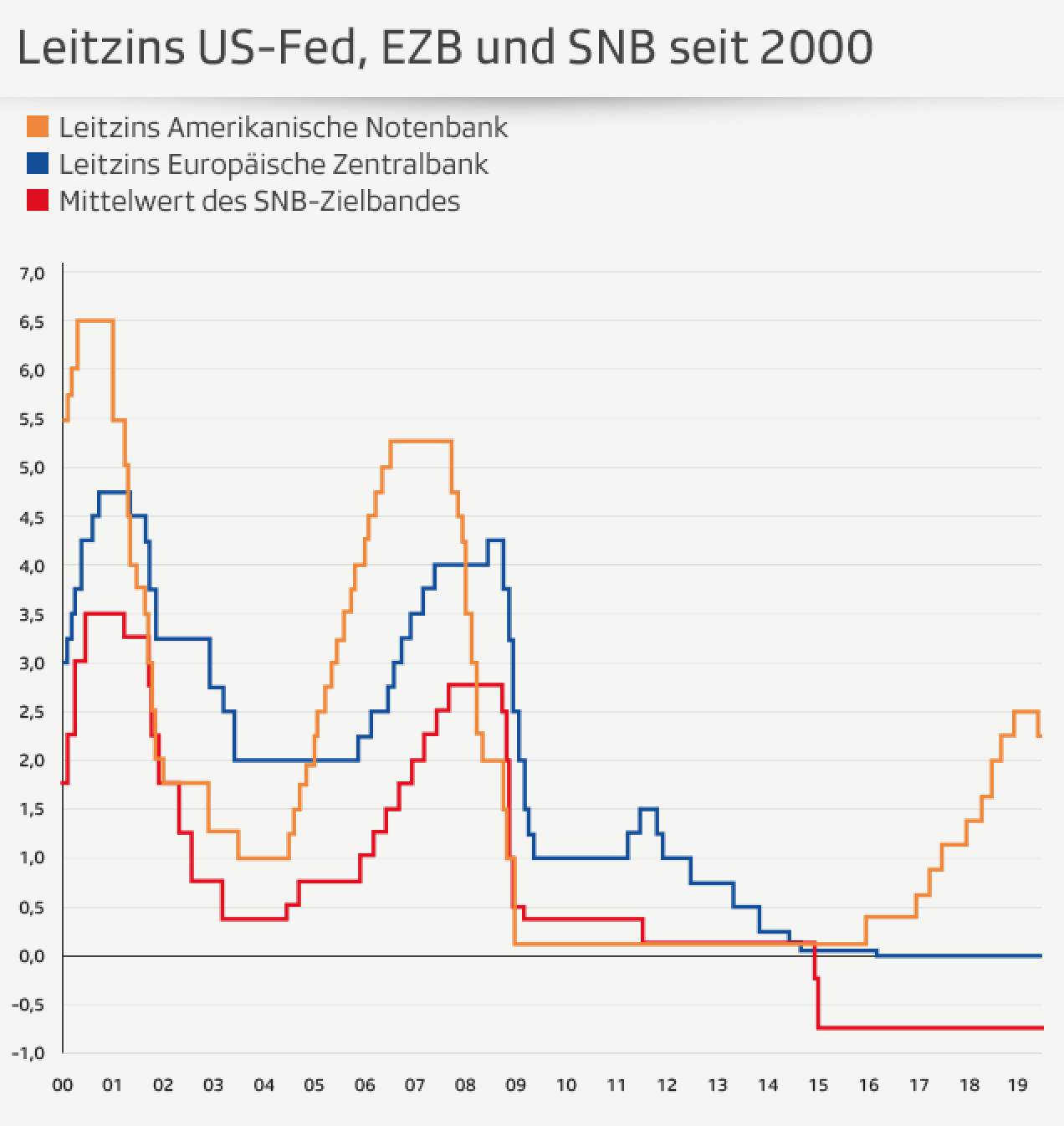

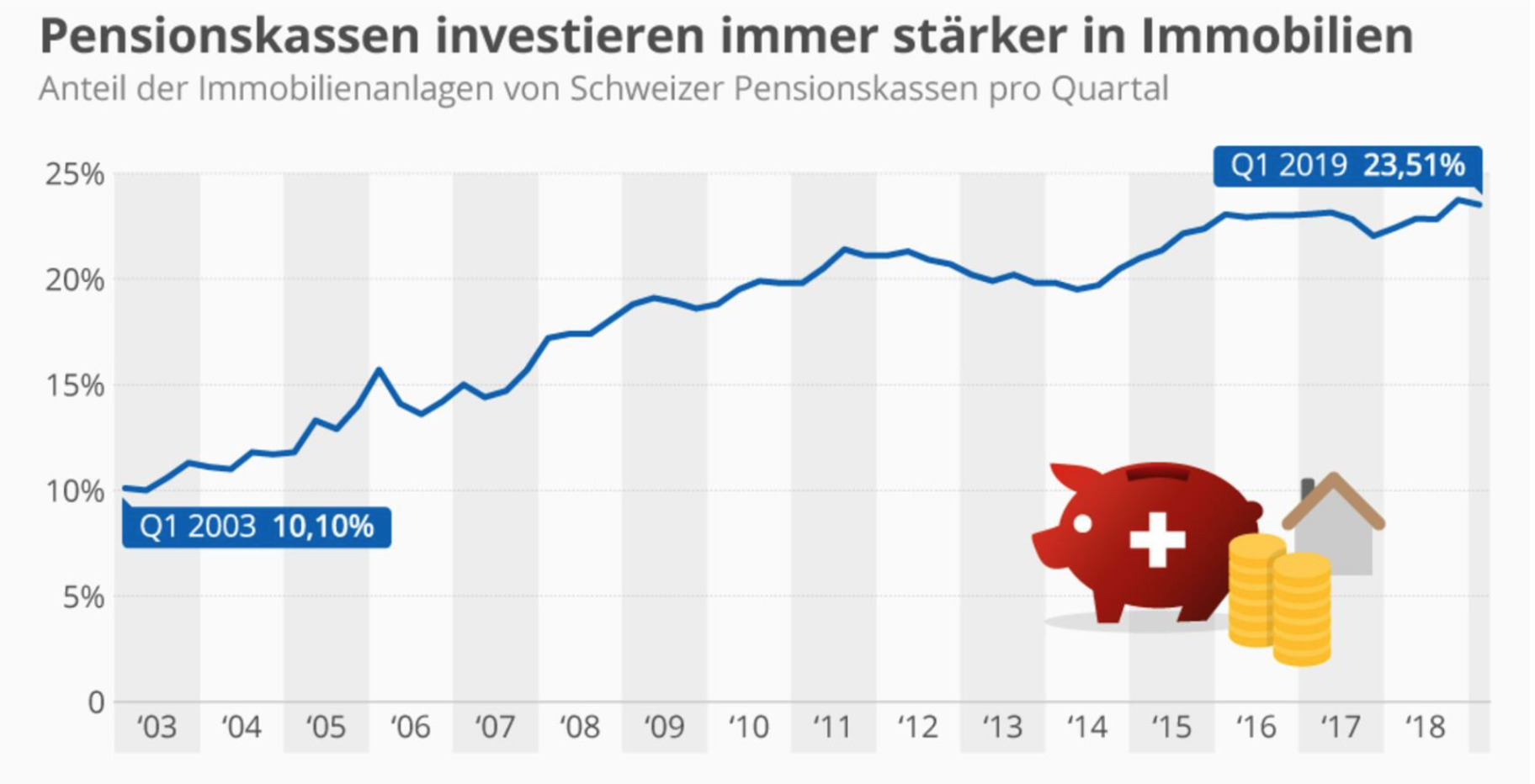

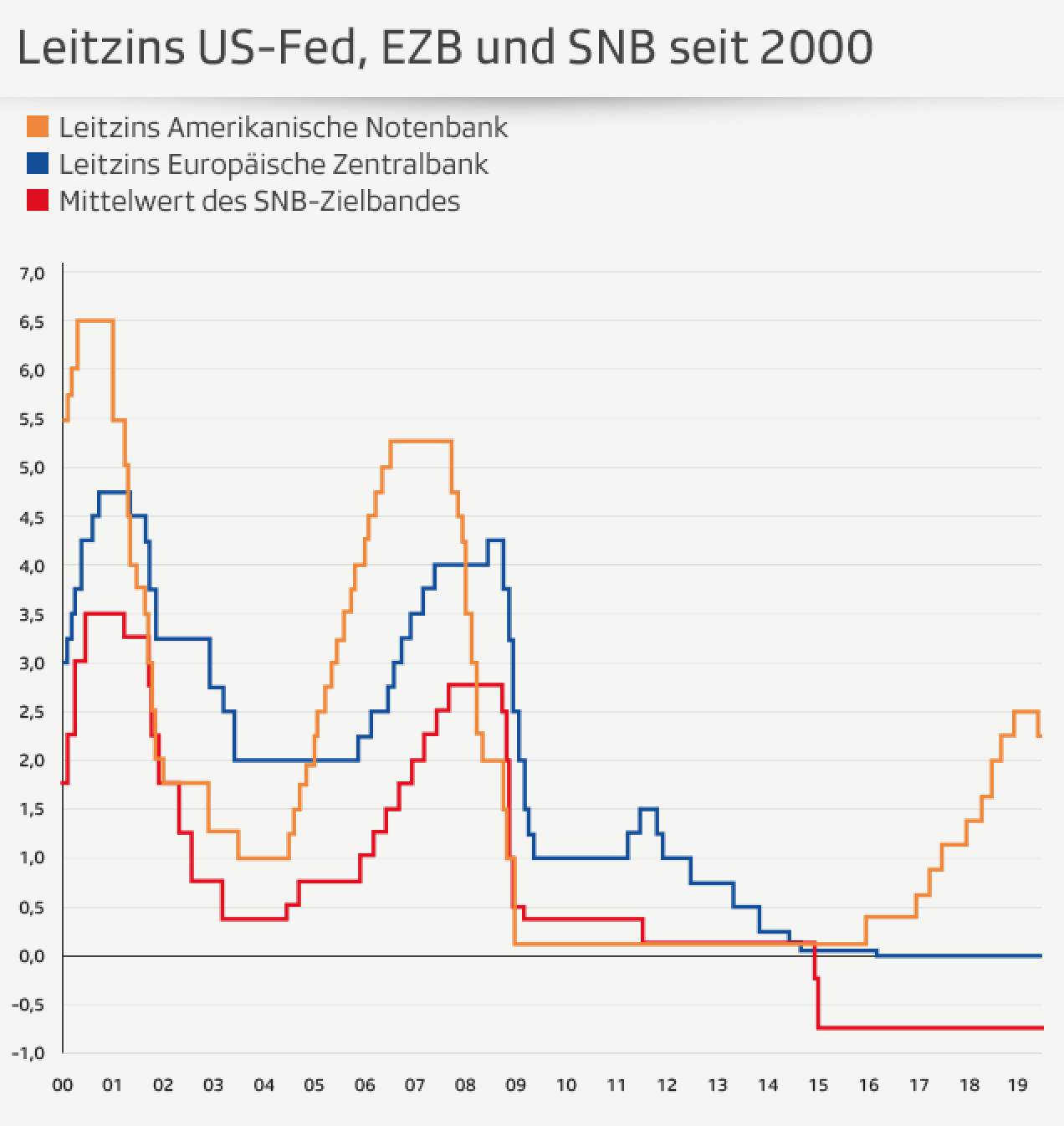

The Swiss National Bank, virtuously caring for the well-being of the Swiss economy, is, in order to uphold the export industry, desperately keeping the value of the currency on the lowest possible – with an „ultra-loose monetary policy“, where the key interest rate is now kept on an all-time minimum of -0.75. This measure has a great effect on how asset investors within Switzerland have to park the money from the pension funds. The Swiss citizens put a certain percentage of their wages into the pension system, which is laid out to generate a maximum asset after the 50 years of depositing money. The targeted conversion rate that the citizens get when they retire anticipates a minimum interest of around 1% – which means that state bonds are no longer a feasible option, since the negative interest rate means to even pay for depositing money in the Swiss National Bank.

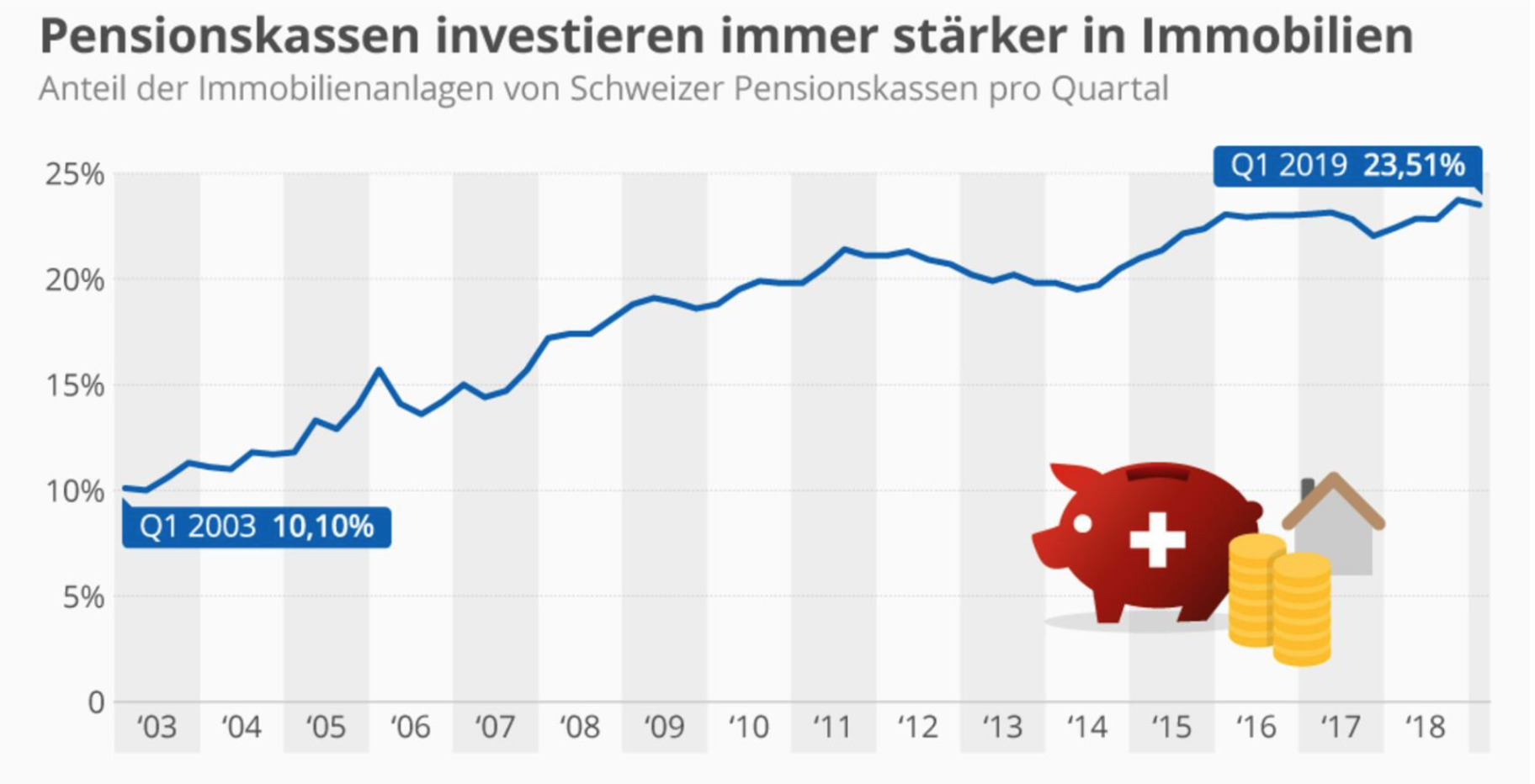

As a consequence, asset investment is increasingly driven into more risky funds – or into one of the few remaining fields of quite profitable money deposit: real estate.

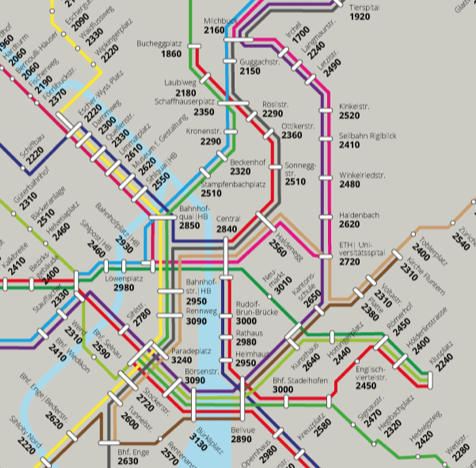

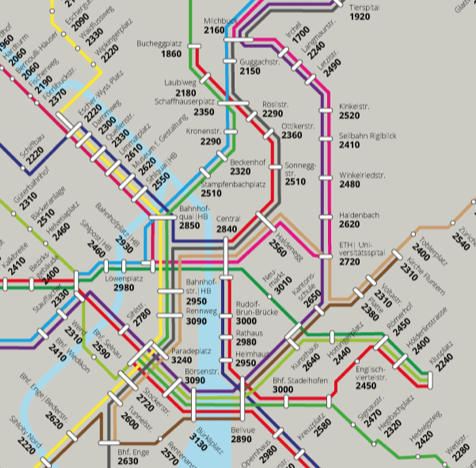

In the last twenty years, the popularity of Zürich as a place to live has been continuously rising. A well-educated middle class is conquering the urban territory, longing for housing in good order. The price level of property and rent has accordingly reached such a high level, that property owners are blessed with market prices that are at a multiple of what they were two decades ago.

The pension funds’ increasing interest in the housing stock is in that context nothing but comprehensible. Nevertheless, they encounter certain restrictions on the legal level: an acquired building can normally never exploit its full financial potential, since the tenancy law protects the existing tenant from an all too quick rising of the rental price, even if the building would be newly renovated.

Anybody invested in real estate is therefore confronted with this paradox interplay of tenancy law and the actually achievable market rent. As the total amount of money that has to be burnt is extraordinarily high and the expected return can only be reached if the there is no previous tenant, asset investors tend to see the one most profitable solution in the act of demolition and replacement.

10CHF, 1997

Bruno Latour, Down to Earth, 2018. illustration by Alexandra Arènes.

Leitzinsmonitoring SNB: The key interest rate of CHF is on -0.75 since 2015.

real estate asset investment statistics, handelszeitung, 2019

The tenancy law keeps the existing rents on a level below the achievable market rent.